Budget 2013: Thinking Small

Titbits

Weakening macroeconomic fundamentals call for radical solutions — not mere fire-fighting

By R. CHAND

It is unanimously acknowledged among economic analysts that lacklustre Budget 2013 is devoid of a credible path of reform and the building blocks for realising a better future. We have been be served the same recipe once more – the ones that have not offered a more cohesive explanation for the problems or any real solutions. A coherent, credible and holistic plan for the long-term economic growth rate of the country is absent despite all the built-up on the 10-year Economic and Social Transformation Plan (ESTP).

We were expecting a slew of reforms in a bid to step up growth in the economy; instead the budget displays a stalled-reform mode – an absence of strong resolve to pursue reforms and break free from its policy paralysis despite the full-blown global crisis that is impacting our economy. With the economy in a corner on a faltering growth trajectory, some hard decisions were inevitable. But our policymakers preferred to take their foot off the reform pedal and focussed their energies on a few populist measures. Thus Budget 2013, like the earlier one, does not have any of the broad-based and inclusive reforms that would generate the necessary productivity improvements and ensure long-term public investments in education, in building skills, in research and innovation, in export expansion and diversification and in boosting the overall growth rate of the economy.

It is a budget bereft of ideas required to forge the new path that Mauritius desperately needs. The policies are too piece-meal to tackle, for example

– the sheer size of the challenges facing education and skill development with a view to enhancing Mauritius’ competitiveness — the biggest gains in education must come from vocational and higher education;

– to be a financial centre of substance oriented to more value addition — we need to develop the “hard” and “soft” aspects of the financial infrastructure;

– to speed up the development of our medical hub — we were expecting a whole panoply of measures to attract some reputed international medical professionals and multinational healthcare/healthcare-related companies to establish headquarters, train and share their expertise in telemedicine, among others, as well as conduct and host healthcare-related research, training and events, etc.

Instead we were served with some quick fixes, some timid approaches, like the Skills Working Group or the Limited Liability Partnership bill for the diversification of the financial sector and the Pre-Clinical Research Bill for the medical hub. Many of these short-term fixes are not aimed at the long term economic future of the country; rather they are aimed at winning elections with some populist handouts. They are seeking refuge from the bigger challenges in the discussion of the specific and the parochial. All this speaks of a lack of rising ambition.

* * *

Marge de manoeuvre – Special Funds

We have wasted precious time; successive budgets lacked ambition and failed to convince people that they hold the solutions to the country’s problems. There are not enough jobs created because there is not enough new investment in capital and promising sectors that would allow incomes to rise. A higher investment rate is crucial to reverse the slowdown. And we have the means to do so.

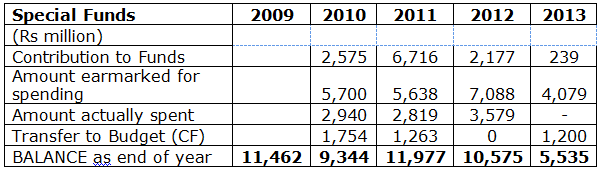

Table I: Special Funds

It is beyond understanding why the fiscal space generated over the past four budgets (see Table I) was allowed to lie lamely in bank accounts. .At the end of every fiscal year there were some Rs 10 billion available. A proper use of these Funds would have helped generate substantial productivity improvements in agriculture, industry, public utilities, health, education, etc., and prepared us for the downturn in the world economy and significantly enhanced our the medium- to long-term growth prospects which would make it relevant to the man and woman in the street who sacrificed short-term gains for the promises of long-term gains.

A crisis is too good to waste. We can take the opportunity of this crisis to revisit many things that we do and the ways that we do them. Such time of crisis calls for an enlightened and visionary leadership that will rally the people in a drive to take advantage of the opportunities inherent in a crisis. Policy makers should take action demonstrating a long-term sustainable approach. There is no such direction as regards economic management. We should mobilize the massive resources available in the Special Funds to set up the building blocks to realise our vision of Mauritius for the next 15 years. One main element of this building block is a full-fledged Planning Unit that can carry out indepth holistic analyses at both micro and macro levels and chart out a forward-looking, dynamic vision of the country that will respond to the aspirations of its people, not a mere assemblage of inputs from different quarters that are then presented as a new vision. That forward-looking, dynamic vision requires constant re-thinking and analysis, reflection and research, greater coherence and coordination across sectors in the formulation and implementation of comprehensive and integrated medium- to long-term policies and programmes. Thus it will be the Vision from a Planning Unit like the National Strategic Transformation Commission (NSTC) that should be providing “les principaux axes guidant l’exercice budgétaire.”

* * *

Weakening macroeconomic fundamentals.

The next few years are likely to see much slower expansion. The combination of factors – including higher inflation as a result of an assumed depreciation of the nominal exchange rate of the rupee by 3.5% annually, higher cost of capital and higher budget deficits (By using Government Finance Statistics Manual 2001

(GFSM 2001) methodology and integrating the Special Funds in the budget, the budget deficits for 2012 and 2013 work out to be 3% and 3.5% respectively) and weak global demand and capital markets – may cause a further slowdown in growth. The 4% growth posted for 2013 in the medium-term macroeconomic projections of the budget based on the assumptions relating to an increase in the number of tourist arrivals by around 5%-8% during the period 2013-2015, an improvement in the implementation rate for projects under the PSIP (Public Sector Investment Programme) and 100% implementation of measures within the time frame set out in the budget may turn out to be too optimistic. The IMF forecast for Mauritius’ real GDP growth rate in its October issue of the World Economic Outlook is only 3.7%.

Indeed the economy has thrown up many vulnerabilities and challenges. GDP growth is slowing down and key sectors are in progressive decline. Despite the concessions that were given to the private sector in Budget 2012 to boost investment, private investment has not responded; its growth is expected to be negative at -3.3 % in 2012 from 1.9% in 2011 and 0% in 2009. Private sector investment as a percentage of GDP decreased from 18.2% in 2011 to 17% in 2012. Total investment has contracted by 0.7% growth in 2012 following the sluggish growth of 0.3 % in 2011.

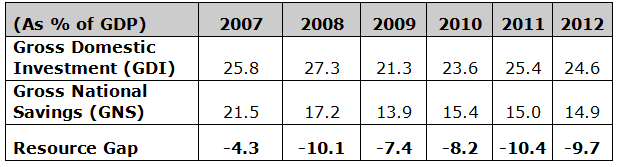

Table II: Resource Gap

The Resource Gap, which is the difference between investment and savings, has widened considerably from Rs 21 billion in 2009 to an expected Rs 33 billion in 2012. As a percentage of GDP, it increased from -4.3 % in 2009 to –10.4 in 2011. This trend is clearly unsustainable

The external trade balance has been deteriorating since 2005 from -13% of GDP to reach a high of -23% in 2008 and it stood at 22.3 in 2011. Exports of goods, a significant driver of the economy, which made up some 29% of GDP in 2007, now stands as low as 23% of GDP. The growth rate of the services sector was not high enough to compensate for the high level of trade deficit. The current account balance has deteriorated rapidly from -5% in 2005 to -10% in 2011. This is higher than the 9% allowed by SADC macroeconomic convergence targets.

Job creation has been slowing down to a mere 0.3% in 2011 whereas unemployment is increasing. There were 46,100 unemployed persons in 2011. Moreover developments like the rising corporate and household sector Indebtedness, slow productivity growth and rising unit labour costs and lower FDI inflows will definitely affect our growth rate and competitiveness. The weakening macroeconomic fundamentals call for radical solutions — not mere fire-fighting.

* Published in print edition on 23 November 2012

An Appeal

Dear Reader

65 years ago Mauritius Times was founded with a resolve to fight for justice and fairness and the advancement of the public good. It has never deviated from this principle no matter how daunting the challenges and how costly the price it has had to pay at different times of our history.

With print journalism struggling to keep afloat due to falling advertising revenues and the wide availability of free sources of information, it is crucially important for the Mauritius Times to survive and prosper. We can only continue doing it with the support of our readers.

The best way you can support our efforts is to take a subscription or by making a recurring donation through a Standing Order to our non-profit Foundation.

Thank you.