The Central Bank hawkish on inflation

By R. Chand

The corporate world, investors and exporters were expecting either a neutral policy stand or a mild calibrated action from the Central Bank in its efforts to rein in inflation. The Monetary Policy Committee (MPC) of the Central Bank has decided by a majority vote to raise the key repo rate by 50 basis points to 5.25 per cent per annum. The decision puts an end to its earlier cautionary monetary stance (when the benchmark interest rate was left unchanged at 4.75% to tackle the financial and economic crisis) for a monetary tightening despite the possible downside risks to economic growth given the uncertain economic environment.

The increase in the interest rate is principally driven by the need to curb in inflationary pressures. The CB claims that the action was “imperative in order to avoid Mauritius being hit by double-digit inflation”. The latter has been mainly driven by higher food and energy prices. The Bank of Mauritius (BoM) seems not to expect the hike in interest rate to impact significantly on the currency evolution, but it leaves room for further increase in the repo rate, if need be.

The Central Bank has decided that the mix of policy tightening, like the increase in the cash reserve ratio from 6% to 7%, needed to shift much more decisively towards higher interest rates. The longer the aggressive monetary tightening is deferred, the more wrenching will the ultimate policy adjustment — and its consequences for growth and employment — be. With inflation — both headline and core — now on an accelerating path, the MPC could not afford to slip further behind the curve and get caught in a policy trap.

Some economists are of the opinion, however, that the BoM has been too pre-emptive in its hawkish attitude to inflationary pressures. This does not mean that it should be soft on inflation but it is the timing that is crucial. The Reserve Bank of South Africa, for example, kept its benchmark repo rate on hold, last week, but raised its inflation and growth forecasts, reinforcing expectations that interest rates will start to rise later this year. They are moving in a measured manner while at the same time trying to tackle gains in the rand currency which were not solely driven by capital inflows.

The rand had gained about 12 percent against the dollar last year despite the Central Bank spending just under 55 billion rand accumulating reserves. It was the second time this year the Central Bank has left rates steady, after cutting the repo rate by 650 basis points between December 2008 and December 2010 to take borrowing costs to their lowest in more than three decades. They explained their dovish attitude by the external risks to growth and the fact that the growth recovery is still not strong enough to boost employment and, most importantly, they are yet to see second-round effects of the inflationary pressures.

Our MPC seems to be laying out a simple red line to hike rates. They should have waited for the second-round inflation pressures — the second round effect of higher wage demand and input price increase — as all they see in CPI forecast now (even if risks are significantly on the upside) are cost push pressures. But most central bankers will counter argue that given the historic caution about recognising second-round effects and the fact that models underestimate second-round effects, it is preferable to be wise before rather than after the event.

I would like to add here that the global crisis has not battered the econometric models which underpinned the world economic edifice but the common underlying assumptions they feed into these models; these have become more complicated and more interdependent as the economic centre of gravity shifts to the east and pressure on global energy, global resources and global food supply builds up.

* * *

The “fat cats” and an appreciating rupee

Unfortunately the hike in interest rate will cause a significant increase in the cost of money and everybody in the chain will be affected. The BoM thinks that this may be the inevitable price that producers/exporters in the economy will have to pay for macroeconomic stability. This new rate will cause manufacturers and exporters serious pain because it has a ripple effect on the cost of production across the entire value chain leading to a further spike in the already ballooned cost of production in the country that adds to the tribulations of an appreciating exchange rate.

As pointed out by Professor Joseph E. Stiglitz, “Mauritius is confronting a loss of exchange-rate competitiveness. And as more and more countries intervene to weaken their exchange rates in response to America’s attempt at competitive devaluation through quantitative easing, the problem is becoming worse. Almost surely, Mauritius, too, will have to intervene.”

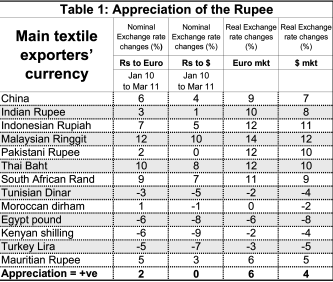

Table 1 : Appreciation of the Rupee

For the last fifteen months, a comparative analysis of the textile producing countries showed that, with very few exceptions, the rupee has been appreciating against the Euro and the dollar. In real terms, we have been appreciating around 5-6% — meaning that we have not been able to maintain our external competitiveness vis-à-vis some of our immediate rivals, especially some African and Mediterranean countries that have seen a depreciation in their currencies. The appreciation of the Rupee has undermined the competitiveness of enterprises and also eroded their profitability. Has it?

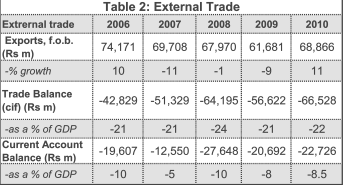

Table 2: External Trade

It will be erroneous to use the substantial growth rate figures in the export of goods for 2010 as argument for postulating that our exports have not been disadvantaged by an the appreciation of the rupee. The recovery in exports growth is from a low base — a trough (please note that 2009 is also exceptional in terms of better trade deficit figures) and exports of goods have yet to reach its pre-crisis level of Rs 74 and Rs 69 billion rupees. But the deteriorating trade and current account deficits as a % of GDP are worrying trends.

This will be welcome to our exporters lobby. Are they the perennial “fat cats” that perpetually hide behind competitive depreciation and pressure government to generate a net transfer of national wealth to them like the fillip that they got from an excessive depreciation of the rupee by the TINAs in 2006 and 2007?

As some countries’ exports are getting affected, some governments are taking several steps to neutralize the effect of currency appreciation. Losses due to currency appreciation are partly being neutralized with lower cost of production emerging from higher productivity (equity participation, restructuring and improvements in management, technology upgrading and product rationalisation and general cost-cutting).

Within the industrial sector also, the effect of rupee appreciation varies among firms. More productive firms can absorb the loss in a better way. Also, due to volatile currency market, firms are being encouraged to adopt sophisticated methods of risk management. Exporters are being told to use forward contract to switch the invoice currency into strong currencies by paying nominal charges without bothering the foreign buyer to change the invoice currency. This is what the TINAS promised to deliver through the Mechanism for Transitional Support to the Private Sector (MTSP) and the Stimulus Packages.

* * *

Stimulus Package Demystified – Hats off to Nita!

As pointed out by the ebullient member of the National Assembly, Hon Nita Deerpalsing, the Financial Secretary, Mr Michael A. Mansoor, a prominent TINAwallah, architect of the “special funds” created outside the Budget, owes us an explanation of the largesse of the stimulus packages which were being coordinated and managed by MOFED. (For too often the Ministry of Finance was let off the hook, especially on the hedging scandals at Air Mauritius and STC and the Rs 233 million package to Microsoft for software licenses; it is time that it becomes more accountable for the allocation and use of public funds).

We had time and again, in these very columns, criticized the Stimulus Packages. “It has only provided temporary reprieve to enterprises without any guarantee that these firms will in future be able to stand on their own. These firms have not committed themselves to any restructuring plan, digne de ce nom. There are very little measures to improve the competitiveness of labour and capital in both the short and long term. A more visionary leadership would have implemented an emergency response while laying the ground for long-term measures… The TINAs ended up approving millions of Rupees for RS Denim and Rs Fashion (and INFINITY BPO and River Heights) while acknowledging that it is not sure of recouping our money !!! And if the Minister is not happy at all about RS Denim, how can we taxpayers be happy at all about a company that is being enquired upon for alleged malpractices and which has a debt of Rs 800 million? This gives the impression that the individual enterprises are feathering their nests with cash and that government is throwing money ‘aux petits copains’ to prop them up. It is just a transfer of wealth from the public purse to the private sector with absolutely no influence over what they do.”

Taxpayers’ money has being used to bail out the fat cats. The Stimulus Package had no mechanism to ensure commitments by the enterprises and the export sector to productivity enhancing measures. The measures — especially the debentures, equity, asset buy-back schemes — of the Stimulus Package only reflected the aim to keep the engine running until external demand picked up again. In other words it only provided short-term liquidity to the failing big enterprises. It amounted to a transfer of wealth from the public purse to the private sector, bankers and parasitic enterprises and institutions – with absolutely no influence over what they did. This short-sighted strategy of an elaborate package of dole-outs that were palliatives at best has led us back to the same precarious situation with the present oil price spikes that threaten an encore of what triggered the Great Recession of 2008.

* * *

Fat cats and a competitive exchange rate

And if our fat cats have not been prepared and trained to play the competitive game — like the previous TEST (Textile Emergency Support Team) productivity enhancing programmes — there may be little choice than to achieve external competitiveness by allowing the rupee to depreciate.

Export-led economies, like Mauritius, cannot take currency appreciation lightly – it undermines competitiveness and risks eroding the country’s share of the global market. Especially when we are fearful of a relapse of end-market demand in a still-shaky post-crisis world, we have to be careful before taking an aggressive stand for price stability. We tend to give as much publicity to Mr J,E. Stiglitz when he praises the Mauritian model of development but not as far as his advice on tackling inflation — “Moreover, like many other countries around the world, Mauritius worries today about imported food and energy inflation. To respond to inflation by increasing interest rates would simply compound the difficulties of high prices with high unemployment and an even less competitive exchange rate”.

To conclude, all these are pointers to a need for a different strategy. The current bout of inflation is caused by a multiplicity of factors, mostly global. Monetary as well as trade policy responses, as has been attempted so far by other countries, would be inadequate to deal with the extant issue effectively. “The Central Bank should be signaling concern (on rising inflation) but not panic… the CB would be within its rights to signal hawkish, but act dovish.”

* Published in print edition on 1 April 2011

An Appeal

Dear Reader

65 years ago Mauritius Times was founded with a resolve to fight for justice and fairness and the advancement of the public good. It has never deviated from this principle no matter how daunting the challenges and how costly the price it has had to pay at different times of our history.

With print journalism struggling to keep afloat due to falling advertising revenues and the wide availability of free sources of information, it is crucially important for the Mauritius Times to survive and prosper. We can only continue doing it with the support of our readers.

The best way you can support our efforts is to take a subscription or by making a recurring donation through a Standing Order to our non-profit Foundation.

Thank you.